Flash Note

2022: a year of active stewardship illustrated

- Published

-

Length

5 minute(s) read

-

81Engagements held

-

98%Meetings voted

-

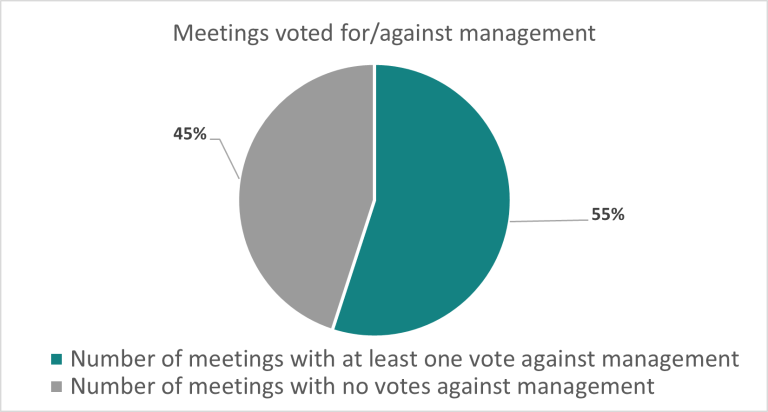

55%Of meetings where Carmignac voted against management at least once

-

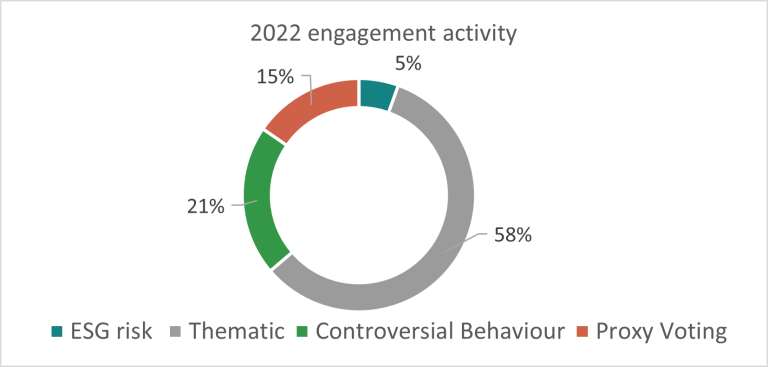

Carmignac held 81 engagements in 2022: -

-

In 2022, Carmignac voted against the management of our investee companies at least once at 55% of the meetings we voted compared to 41% in 2021:

-

The engagements presented below were undertaken in Q4 2022.

Experian

Sector: Professional services

Region: Europe

The Company is held in a number of Carmignac’s equity funds1 .

Teva Pharmaceutical Industries

Sector: Pharmaceuticals

Region: Middle East

The Company is held in a number of Carmignac’s fixed income funds4 .

1As at the date of the engagement reported (November 2022) and the date of publication of this case study (January 2023). Equity funds are Carmignac Grande Europe and Carmignac Portfolio Europe Patrimoine. 2https://carmidoc.carmignac.com/ESGEP_INT_en.pdf

3The proprietary ESG system START combines and aggregates market leading data providers ESG indicators. Given the lack of standardisation and reporting of some ESG indicators by public companies, not all relevant indicators can be taken into consideration. START provides a centralised system whereby Carmignac’s proprietary analysis and insights related to each company are expressed, irrespective of the aggregated external data should it be incomplete. For more information, please consult our ESG Integration Policy: https://carmidoc.carmignac.com/SRIIP_INT_en.pdf

4As at the date of the engagement reported (October 2022) and the date of publication of this case study (January 2023). Fixed income funds are Carmignac Credit 2025, Carmignac Credit 2027, Carmignac Portfolio Evolution, Carmignac Portfolio Global Bond, Carmignac Patrimoine, FP Carmignac Patrimoine, Carmignac Portfolio Patrimoine Europe, Carmignac Sécurité, Carmignac Portfolio Sécurité, Carmignac Profil Réactif 50, Carmignac Profil Réactif 75, Carmignac Profil Réactif 100.

5The proprietary ESG system START combines and aggregates market leading data providers ESG indicators. Given the lack of standardisation and reporting of some ESG indicators by public companies, not all relevant indicators can be taken into consideration. START provides a centralised system whereby Carmignac’s proprietary analysis and insights related to each company are expressed, irrespective of the aggregated external data should it be incomplete. For more information, please consult our ESG Integration Policy: https://carmidoc.carmignac.com/SRIIP_INT_en.pdf