Flash Note

Is 2023 the year to add China to your core allocation?

- Published

-

Length

5 minute(s) read

China's financial markets experienced high volatility recently due to a regulatory crackdown, geopolitical tensions, and an economic slowdown triggered by a draconian zero-Covid policy. But 2023 – the Year of the Water Rabbit, a symbol of peace, a return to normal, and more – could open up a new chapter for Chinese equities and usher in plenty of opportunities, particularly in consumer-oriented sectors.

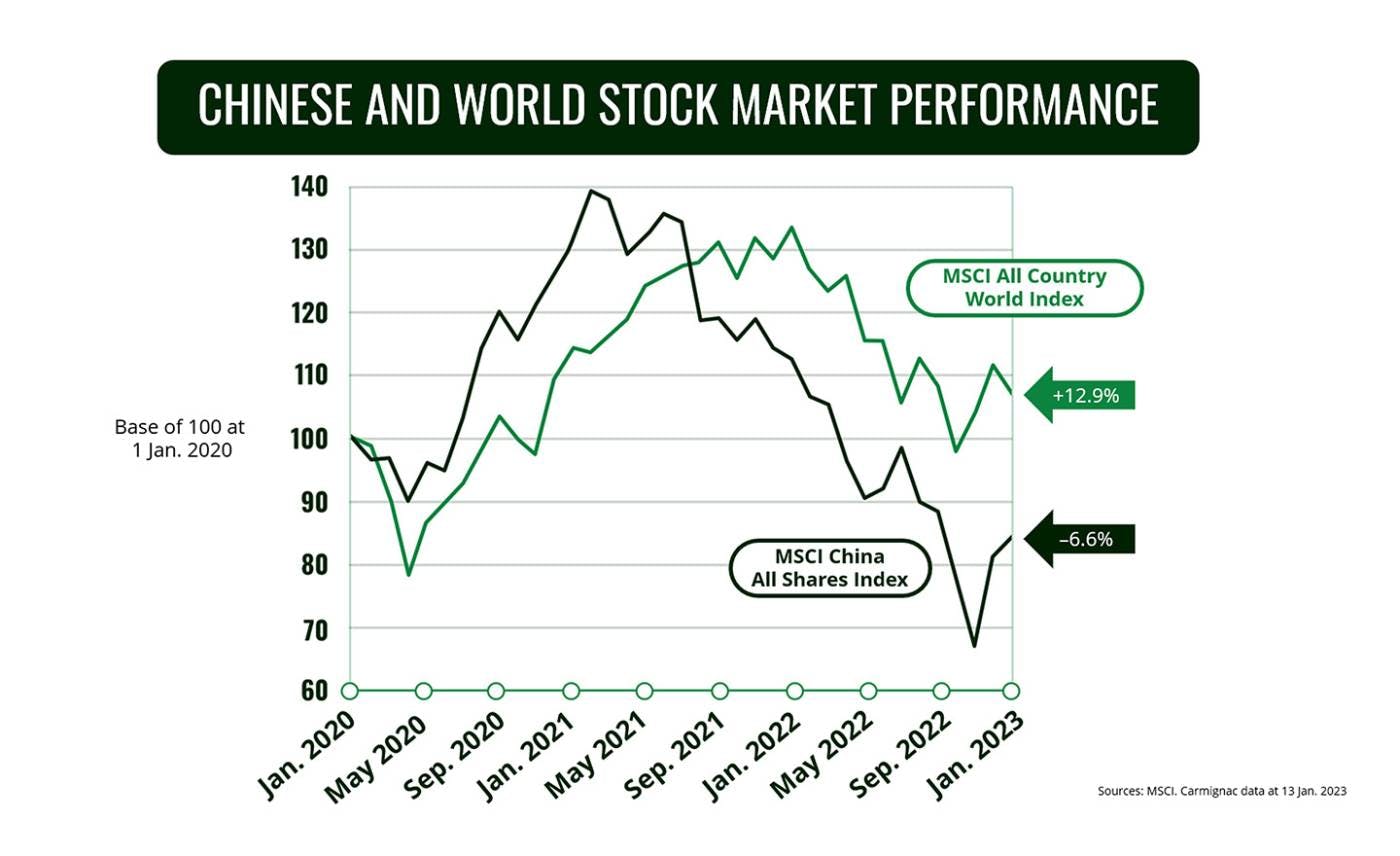

Chinese stocks delivered solid returns in 2020 but then fell sharply in 2021–2022 on the back of several policy decisions and other developments that fuelled foreign investors’ anxiety. These included tighter regulations for certain industries, the financial woes of real-estate giant Evergrande, and stricter transparency requirements for Chinese companies listed in the US. Not to mention Beijing’s strict zero-Covid policy and fears that China would invade Taiwan in the wake of Russia's invasion of Ukraine.

However, 2023 will be a year of normalization for China’s economy and financial markets, which could make its stocks an attractive allocation for investors. Here’s why global asset managers should consider adding Chinese equities to their portfolios.

A brighter future

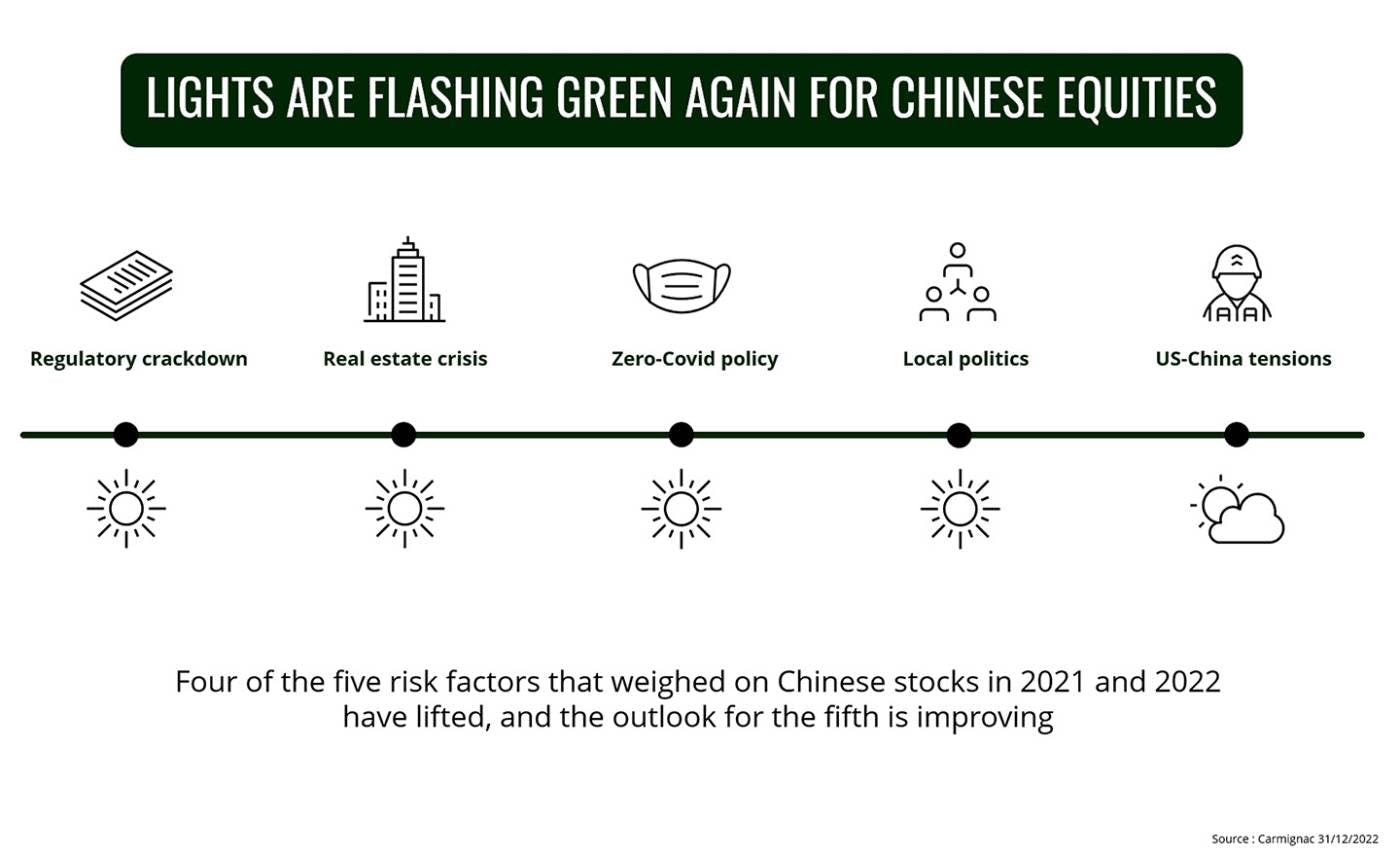

Chinese assets experienced a massive sell-off in the past two years due to 5 risk factors: tighter regulatory scrutiny, especially of large internet firms, real estate crisis, zero-Covid policy, local politics and Sino-American tensions.

For the first four points, the signals have all turned green, as China has not only concluded this period of regulatory tightening, but has also shown support for the private sector, the Internet giants and the real estate sector. Moreover, the government has made concrete changes since the Party Congress in October.

The zero-Covid policy has been lifted and China opened back up on 8 January – somewhat abruptly, but the policy reversal was necessary and is good news for the country and the rest of the world. As for geopolitical tensions with the US, here the risks are still present given that the two countries will remain great rivals. US-China tensions which have jumped back after “Chinese Spy Balloon” incident would not see escalation in our view. We see economic recovery post-covid much powerful driver of Chinese equities in 2023.

Meanwhile, the US Public Company Accounting Oversight Board said it concluded its audit of a first batch of Chinese companies without incident and had secured access to inspect Chinese firms. This pushes off until 2025 the risk that Chinese companies could be delisted from US exchanges, and recent statements by US authorities make it increasingly possible that delistings could be avoided.

The news came just as leading Chinese policymakers, meeting at the China Economic Work Congress (the country’s biggest economic gathering), announced that boosting domestic demand would be a priority in 2023.

In light of China’s earlier-than-expected reopening, the continued easing of policy measures, and the government’s clear shift towards a pro-growth stance, we can expect China’s economy to ramp back up in 2023, although the speed of its reopening could cause some short-term difficulties. We now expect China’s GDP growth to pick up starting in the second quarter and to reach around 5.0% for the full year. This would make China the only major economy whose GDP growth is accelerating.

Sanguine growth prospects fuelled by domestic demand

An upturn in Covid infections will likely weigh on consumer spending in the first part of the year, but things are expected to improve as soon as the second quarter as Beijing implements its pro-growth and pro-consumption measures. Consumer spending will probably also be lifted by:

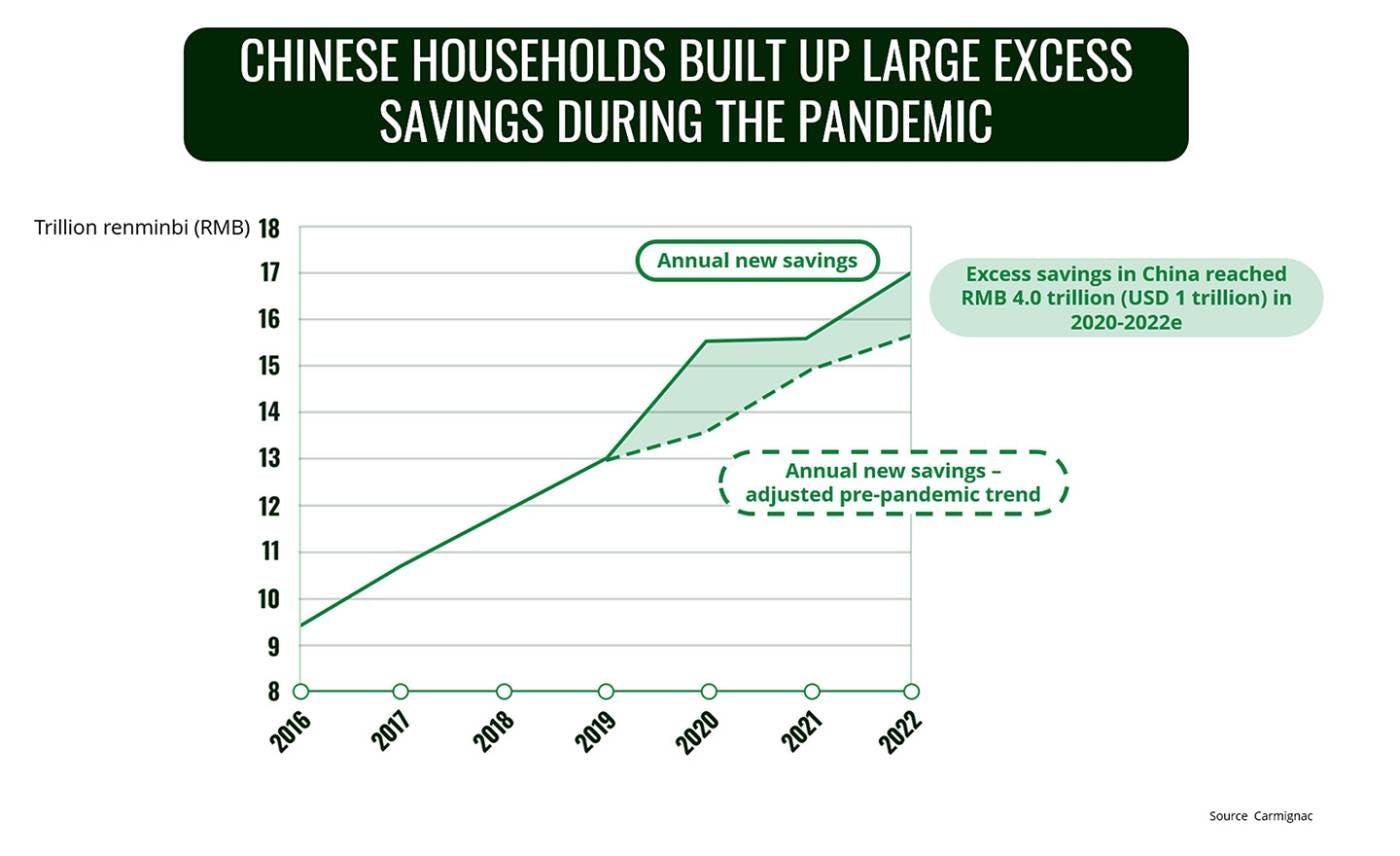

Higher household consumption fuelled by excess savings. Chinese households are now sitting on excess savings of nearly 18 trillion renminbi (2.5 trillion euros), including 4 trillion renminbi accumulated since 2020, largely as a result of pandemic lockdowns.

A job market recovery. Nearly one in five jobs in China is Covid-sensitive because it involves physical contact, which means that the lifting of the zero-Covid policy and the full reopening of China’s economy are likely to stimulate both supply (jobs) and demand (consumer spending). This should underpin a rebound in household consumption.

Other structural growth drivers for domestic demand in China include: a 1.4 billion-strong population; a per-capita GDP of over USD 12,500; a rising household consumption rate; and a five-fold increase in total household consumption between 2005 and 2020. In addition, if we look at household consumption as a percent of GDP, it appears that consumer spending in China, especially in rural areas, has substantial scope for expanding further. Household consumption is now 54.3% of GDP in China – relatively low compared to other major emerging countries and to developed countries (82.6% in the US1, for example), indicating considerable room for improvement.

All these factors point to a sustained increase in Chinese consumer spending. This should drive revenue growth for Chinese companies in consumer-oriented sectors for years to come.

Three other reasons to consider Chinese equities

The market is huge yet still under-represented and under-invested

The Chinese stock market – including A shares, H shares, ADRs, and S shares – has a combined market cap of over USD 19 trillion2, second only to the US, and more than 6,000 listed companies. It simply cannot be overlooked by investors today.

Yet despite the market’s size and momentum, Chinese equities are still under-represented in portfolio allocations and global equity indices. Chinese companies make up only around 3.6% of the MSCI All Country World Index, compared to 60.4% for US companies and 5.6% for Japanese ones. Foreign investors are 4% underweight Chinese domestic equities in their portfolios.

Chinese businesses are priced attractively

Even though the MSCI China Index is already up 35% from its October low3 on expectations of the country’s reopening, we’re still constructive on China since valuations are attractive. The MSCI China Index is trading at a price-to-earnings (P/E) ratio of around 11, slightly below its 10-year average, while global equities are trading at a P/E ratio of around 15.

In addition, we see positive earnings momentum. Unlike in the US, where earnings are expected to be weak, Chinese companies will probably experience an uptick in profits. Most Chinese companies have cut costs over the past three years, so top-line growth should drive an earnings recovery in 2023.

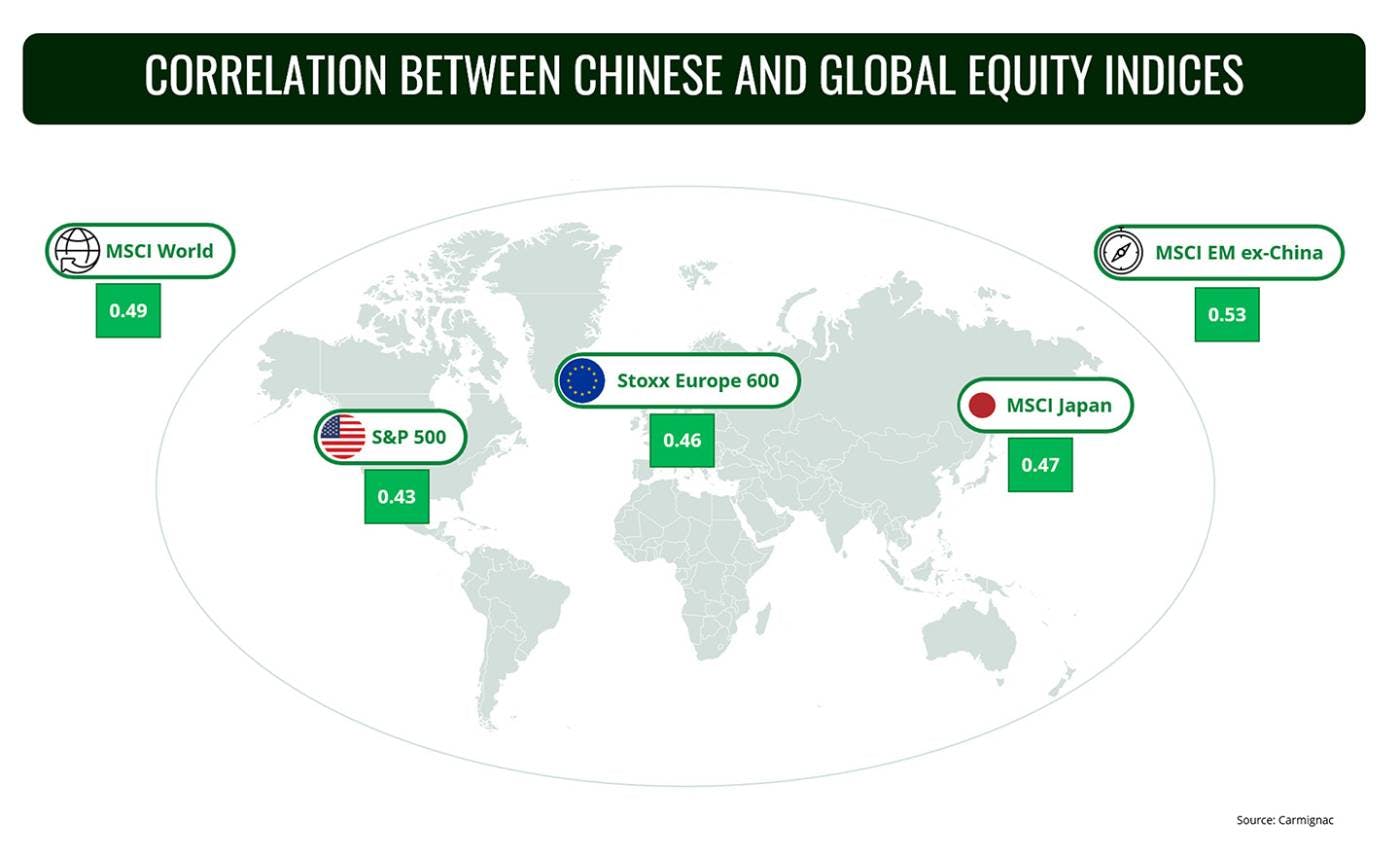

China offers portfolio diversification

Chinese equities can be an effective portfolio diversifier in terms of geographic exposure given their low correlation with other stock markets (that’s especially true for domestic A shares).

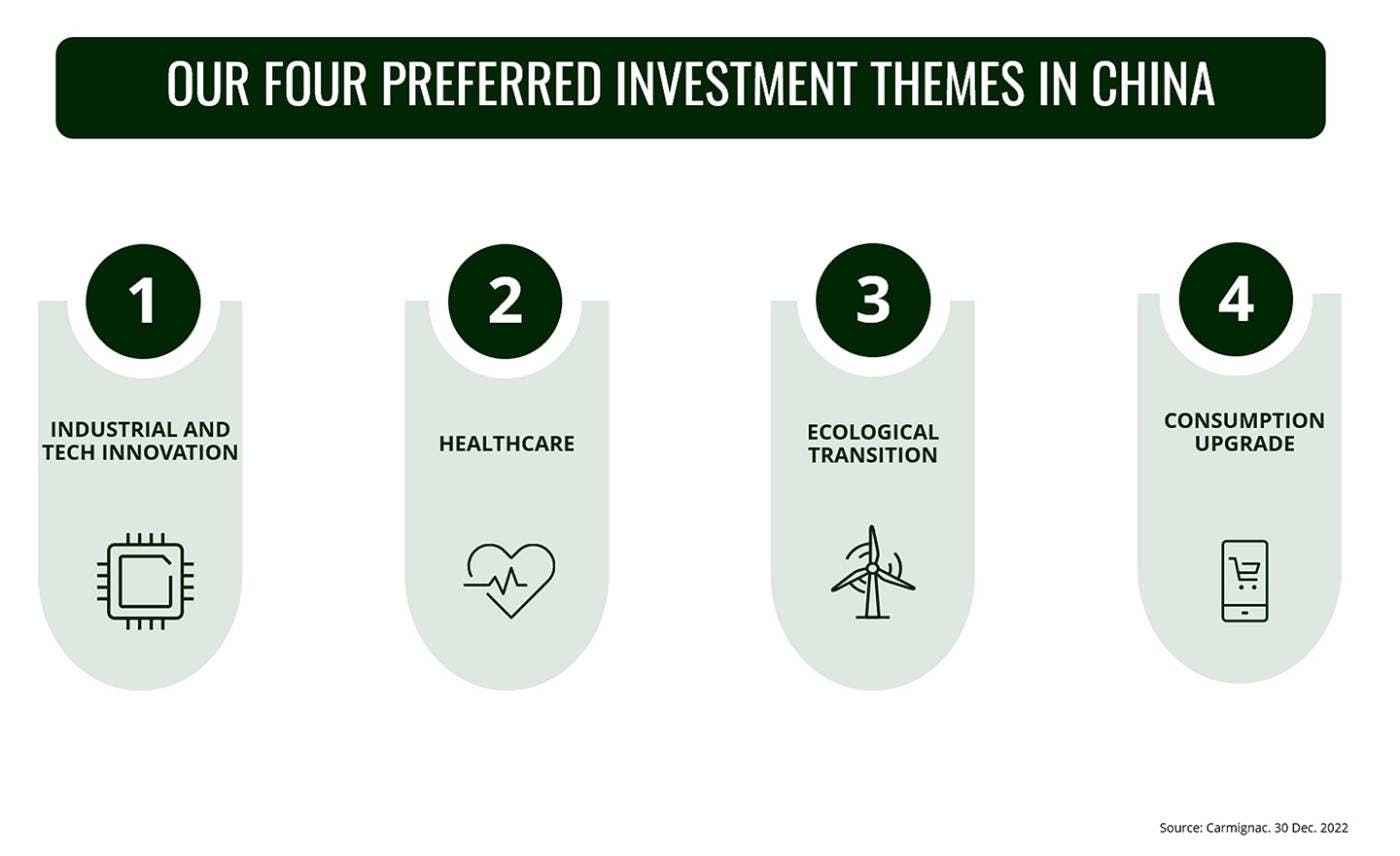

What’s more, Chinese society is rapidly becoming more digital, urban, innovative, and sustainability-focused – structural changes that equity investors can best take advantage of through thematic investments. We see particularly strong potential in four key areas of the new economy: 1) industrial and technological innovation; 2) healthcare; 3) ecological transition; and 4) consumption upgrade. This latter theme in particular could perform well in 2023 given the record level of Chinese household savings.

After 20 difficult months, 2023 could mark a new beginning for Chinese financial markets. It’s only a matter of time before China becomes a strategic asset class for international investors. However, there are some risks worth keeping an eye on (like an upswing in Covid infections and geopolitical developments), but we believe many of them can be mitigated through active portfolio management. At Carmignac, we’re convinced that a selective, benchmark-agnostic approach is essential for spotting the most attractive investment opportunities, particularly in China’s vast equity market. That’s why our Chinese investments are focused on our key convictions, which tend to differ from the holdings in the main Chinese equity indices.

1Sources: World Bank, final consumption expenditure % GDP

https://data.worldbank.org/indicator/NE.CON.TOTL.ZS?locations=CN

2Source : Bloomberg, CICC Research, 2022

3Source : Bloomberg, MSCI China Index return in USD from 31/10/2022 to 30/12/2022.