Flash Note

Q2 2022: a quarter of active stewardship illustrated

- Published

-

Length

4 minute(s) read

-

12engagements held

-

97%meetings voted

-

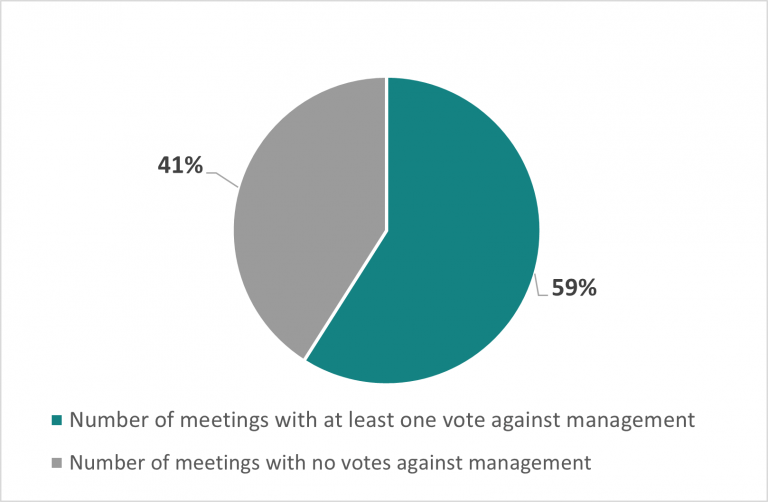

59%of meetings where Carmignac voted against management at least once

-

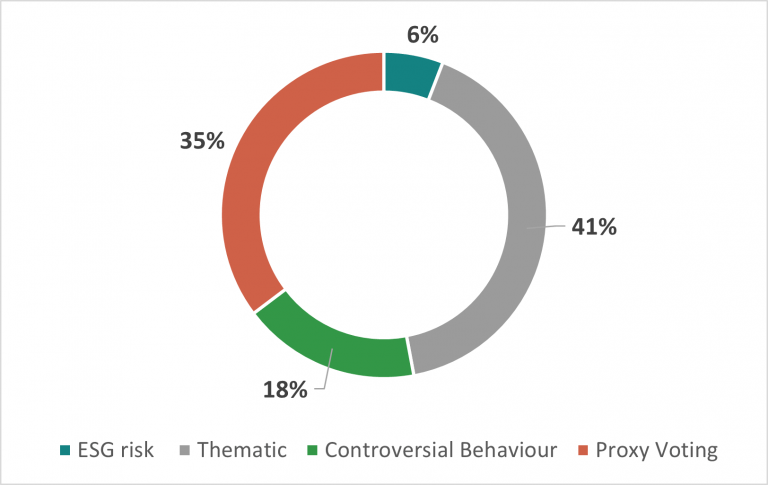

Carmignac held 12 engagements in the second quarter of 2022: -

Q2 2022 engagement activity

-

In Q2 2022, Carmignac voted against the management of our investee companies at least once at 59% of meetings voted:

-

Meetings voted for/ against management

Arcos Dorados

Sector: Consumer Discretionary

Region: North America

The company is the largest independent McDonald’s franchisee, operating in Latin America and the Caribbean. It is held within a number of Carmignac’s fixed income funds1.

Amazon

Sector: Consumer Discretionary

Region: North America

The company is held on behalf of a number of Carmignac’s equity funds4.

1As at the date of the engagement reported below (May 2022) and the date of publication of this case study (August 2022)

2https://carmidoc.carmignac.com/SRIIP_INT_en.pdf

3The proprietary ESG system START combines and aggregates market leading data providers ESG indicators. Given the lack of standardisation and reporting of some ESG indicators by public companies, not all relevant indicators can be taken into consideration. START provides a centralised system whereby Carmignac’s proprietary analysis and insights related to each company are expressed, irrespective of the aggregated external data should it be incomplete.

For more information, please refer to our website.

4As at the date of the engagement (March 2021) and the date of the publication of this case study (August 2022).

5We cast a vote “for” on the following resolutions:

- Resolution 6 - Commission Third Party Report Assessing Company's Human Rights Due Diligence Process

- Resolution 8 – Report on Efforts to Reduce Plastic Use

- Resolution 12 – Publish a Tax Transparency Report

- Resolution 13 – Report on Protecting the Rights of Freedom of Association and Collective Bargaining

- Resolution 16 – Commission a Third-Party Audit on Working Conditions

- Resolution 17 – Report on Median Gender/Racial Pay Gap

- Resolution 19 - Commission Third Party Study and Report on Risks Associated with Use of Rekognition

6For more information, please refer to our ESG Integration Policy