Funds in Focus

![[Main Media] [Flash Note] [CP] Coloured buildings Carmignac Patrimoine](https://carmignac.imgix.net/uploads/article/0001/05/7dbc9184f5a55630cf58e292377f78eb1c2de428.jpeg?auto=format%2Ccompress)

Carmignac Patrimoine: The advantages of investing across the capital structure

- Published

-

Length

3 minute(s) read

In the end, it all comes down to where we think the risk/reward profile is best for us

Asset allocation funds are a turn-key solution for clients looking for diversification, with investments in different asset classes.

Clients expect such funds to have a balanced allocation between equities and bonds, with cash as the adjustment variable. This typically leads them to consider these types of funds as two separate investment pockets. This is particularly tempting when two Funds managers with two distinct market expertise manage the Fund.

However, an asset allocation fund can really stand out if the Fund managers think of the portfolio construction as a whole, and leverage on each other’s perspective with an unconstraind approach.

How our diversification process stand out from others?

Since they manage the Fund together, Rose Ouahba and David Older have spent a lot of time thinking about how the different components of the Fund could fit together from a risk perspective and how they can make the most of the various performance drivers at their disposal. In this regard, close contact between the equity and fixed income teams is essential.

Optimizing the asset allocation and risk management

In the midst of the Covid crisis, we were seeing huge dislocations in the credit market and naturally wanted to hedge our exposure. We used credit derivatives, but to be even more agile, part of Beta of the credit book was hedged by calibrating some short positions on European equity indexes. Indeed, they have a strong correlation to credit in down markets, are highly liquid and easy to implement.

Investing across the capital structure at the bottom-up level

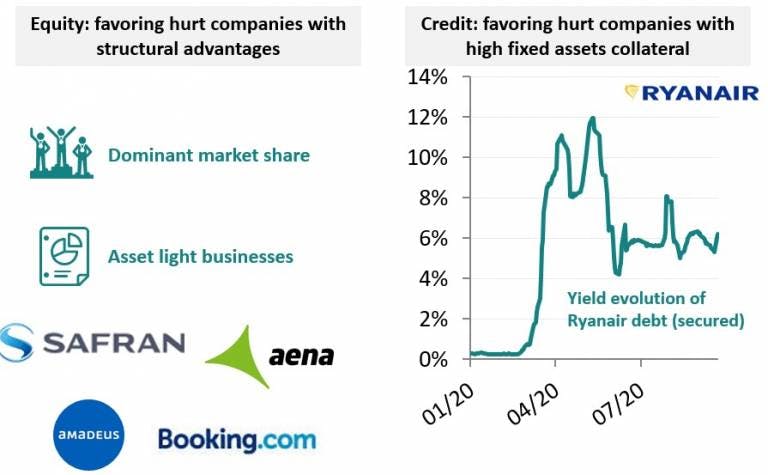

In order to gradually increase the cyclicality of Carmignac Patrimoine, a new thematic emerged in April/May with future beneficiaries of the reopening of economies. From this point of view, the indiscriminate sell-off of the travel industry has created some attractive entry points on some issuers. Nevertheless, such companies are not necessarily attractive in terms of both equity and debt.

-

Source: Carmignac, Bloomberg, 30/09/2020

Portfolio composition may change -

For example, airline companies have been severely hit by the crisis and their asset-heavy and leveraged profile damaged their profitability, making them less attractive for equity investors and leading us to sell our positions in March 2020.

Source: Carmignac, Bloomberg, 30/09/2020. Portfolio composition may change

However, their high tangible assets (namely planes) act as collateral for the cash they’re raising, making our credit team confident about their ability to refinance themselves and reimburse their debt over the mid-term. On the equity side, we have a preference for asset-light companies like the leading Spanish travel ticketing software platform.

Optimizing the sector allocation across the capital

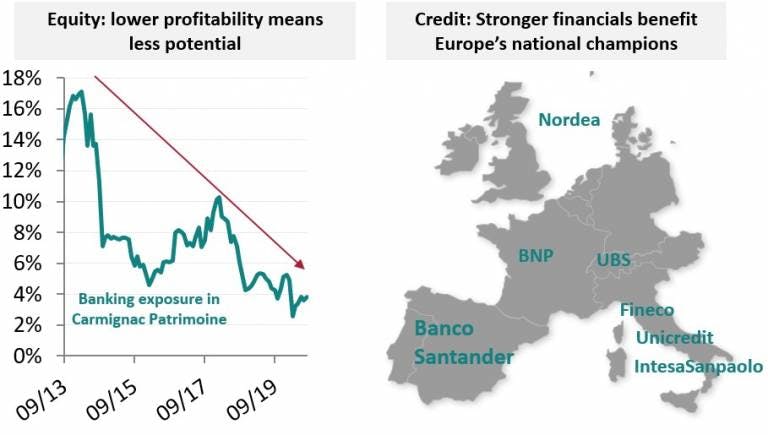

Years of financial repression have kept interest rates at extremely low levels, substantially denting on banks’ profitability. In the meantime, tighter regulation has forced these institutions to increase their core tier 1 ratio (key measure of a bank's financial strength that has been adopted as part of the Basel III Accord on bank regulation), effectively making them more resilient to systemic risks.

-

Source: Carmignac, Bloomberg, 30/09/2020

Portfolio composition may change -

We have as a result drastically lowered our equity banking exposure over the years (our equity approach instead seeks disruption, which we find in fintech).

Source: Carmignac, Bloomberg, 30/09/2020. Portfolio composition may change

Conversely, we have invested in subordinated debt of firmly rooted banking players in Europe (so-called national champions), inferring that fiscal and monetary support would continue.

Since the beginning of the year, Carmignac Patrimoine A EUR share class posted +7.8% vs +2.6% for the reference indicator1. It beats 96% of its peers2 since the beginning of the year.

Carmignac Patrimoine A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | +8.81 % | +0.72 % | +3.88 % | +0.09 % | -11.29 % | +10.55 % | +12.40 % | -0.88 % | -9.38 % | +2.20 % | +7.06 % |

| Reference Indicator | +15.97 % | +8.35 % | +8.05 % | +1.47 % | -0.07 % | +18.18 % | +5.18 % | +13.34 % | -10.26 % | +7.73 % | +5.28 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | -1.70 % | +2.69 % | +1.93 % |

| Reference Indicator | +2.59 % | +5.21 % | +6.39 % |

Scroll right to see full table

Source: Carmignac at 28/06/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,51% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,63% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

1 50% MSCI ACWI (USD) (Reinvested net dividends) + 50% Citigroup WGBI All Maturities (EUR). Quarterly rebalanced. 2 EAA Fund EUR Moderate Allocation Source: Carmignac, Bloomberg, 04/11/2020. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor). © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Carmignac Patrimoine E EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.