Quarterly Report

Carmignac Emergents : Letter from the Fund Managers

What happened in emerging markets during the second quarter of 2021?

The Chinese equity market suffered a rout that was in no way correlated with the country’s economic indicators. These still point to high growth even though Beijing’s monetary and fiscal policies are more orthodox than in the world’s other leading economic regions. In our view, China is home to the world’s most effectively managed economy in this year of recovery. Inflation is low, the balance-of-payment surplus is rising and the central bank has enough running room to inject liquidity to keep the economy humming whenever that seems appropriate.

The equity-market slide is due rather to state action. To protect consumers, the Chinese government has been exerting considerable pressure on many of the country’s listed companies for alleged antitrust violations. The first firms in the firing line have of course been the top big-tech names that have emerged as the clearcut winners in the unfolding technological revolution – i.e., local counterparts to GAFAM like Tencent, Alibaba, Meituan and Pinduoduo. A further target of the crackdown are private-sector education companies accused by Beijing of charging excessively high tuition. And towards the end of the quarter, the government went after Didi, China’s answer to Uber, for daring to pursue public listing in New York, whereas the authorities had pushed for listing in Hong Kong. Retribution came in the form of a cybersecurity investigation in the name of user privacy just days after Didi’s IPO. These various actions sparked a broad selloff in Chinese equities that proved detrimental to our portfolio – even though none of the names we hold were directly affected by the latest measures.

Portfolio adjustments and current positioning

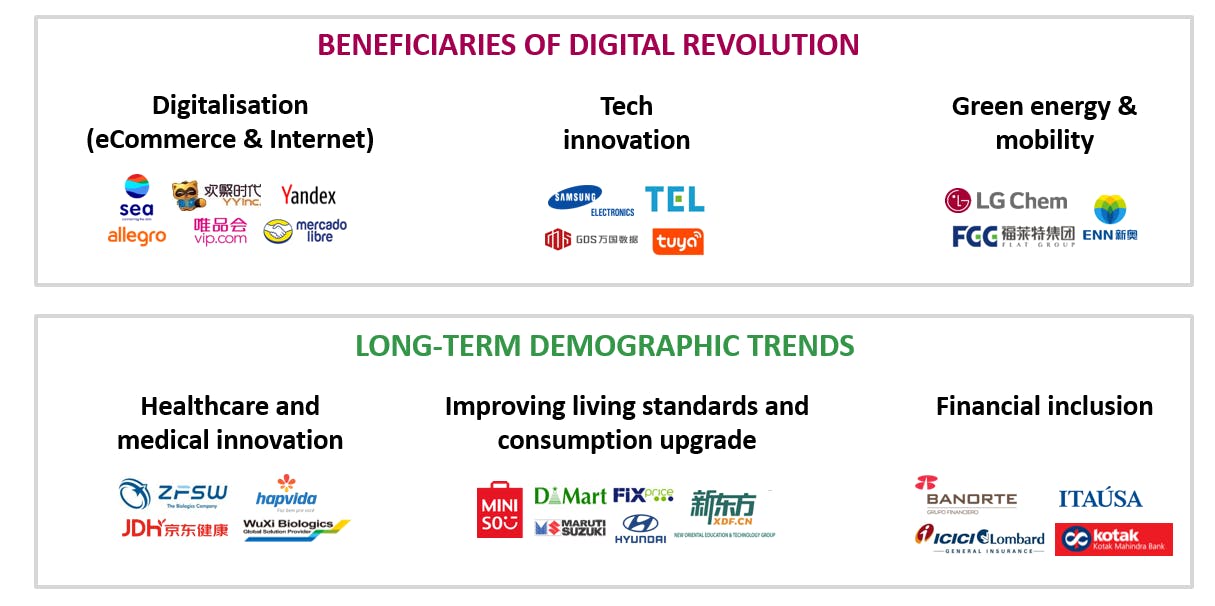

Focus on Beneficiaries of Digital Revolution & Long-Term Demographic Trends

Since the recent market tumble, we’ve seen some great buys at what are now highly attractive prices. We took advantage of the selloff to beef up specific holdings like VIP Shop, which was trading at an inordinately low P/E multiple (7 times the firm’s EBITDA1) and JOYY, which was selling at a price that seemed completely oblivious to the company’s Bigo Live business in Southeast Asia, which in our opinion accounts for nearly half of JOYY’s value. We also initiated a position in New Oriental Education after the company’s share price fell 60%. We considered that an unreasonable drop for a firm that has an extremely solid balance sheet after raising a large amount of capital through its secondary listing in Hong Kong.

Elsewhere in Asia, we acquired a stake in Japanese company Tokyo Electron. Though Japan is not an emerging market, Tokyo Electron earns two thirds of its revenue from customers in the emerging world, and therefore seemed to be a good fit with the Fund’s investment universe. We have had holdings for years now in the semiconductor industry, which has enjoyed steadily rising demand due to the tech revolution under way. We expect that revolution to accelerate as 5G, self-driving cars and the Internet of Things gain further traction. And in addition to those positives on the demand side, we feel the industry has a most attractive supply structure, with highly profitable oligopolies. Our favourite investment in semiconductors is still Samsung Electronics, a firm with unchallenged leadership in the memory segment (DRAM and NAND). That said, Tokyo Electron also appears to be in an excellent position to cash in on the heavy capital spending planned by manufacturers, as its photovoltaic (PV) cell production-equipment business has a quasi-monopoly2. Furthermore, Tokyo Electron ticks all the right boxes in our SRI process, as well as in regard to our governance and climate-risk management requirements. The firm has set itself extremely clear and precise targets for cutting carbon emissions by 2030 and again by 2050. And with independent members making up one third of its Board of Directors, Tokyo Electron pursues shareholder-friendly policies, particularly in relation to transparency and the appropriation of equity.

Our portfolio is still preponderantly focused on Asia (75.8% of net assets)3, where GDP growth is higher and economic governance better than in other emerging and developed markets. This is also the region that in our view offers the largest pool of innovative tech and web companies. Those companies are already at the forefront of the digital revolution, and will stay there.

It’s also worth stressing that the Fund has diversified geographic exposure, with sizeable investments in Latin America (12.7% of net assets)3 and Russia (6.4% of net assets)3. Both of those regions are running balance-of-payment surpluses and offer attractive valuations since their currencies suffered a disproportionate depreciation in 2020 that was utterly uncoupled from prices for the raw materials they export. During the second quarter, we thus upped our holdings in Mexican bank Grupo Banorte and in Hapvida, a Brazilian healthcare company. We still maintain that the emerging-market rally will be more uniform in 2021 than it was in 2020, when Asia was the only region turning in positive performance.

![[Logo] Double Label ISR 450x240](https://carmignac.imgix.net/uploads/article/0001/11/3f0cbd6155ed4714b53c2b442d8e3681f653b1f0.jpeg?auto=format%2Ccompress)

Carmignac Emergents is classified as an Article 8 fund under the Sustainable Finance Disclosure Regulation (SFDR)4, and was awarded France’s SRI certification in 2019 and Belgium’s Towards Sustainability label in 20205.

Our portfolio is currently structured around six major socially responsible investment (SRI) themes that are central to our processes.

As explained elsewhere, we take a three-pronged approach to social responsibility:

- Invest selectively and with conviction, giving priority to sustainable growth themes in underinvested sectors and countries with sound macroeconomic fundamentals.

- Invest for positive impact, favouring companies that deliver solutions to environmental and social challenges in emerging markets and reducing our carbon imprint by 70% relative to the MSCI Emerging Markets Index.

- Invest sustainably by consistently incorporating environmental, social and governance (ESG) criteria into our analyses and investment decisions.

Carmignac Emergents A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Emergents A EUR Acc | +5.76 % | +5.15 % | +1.39 % | +18.84 % | -18.60 % | +24.73 % | +44.66 % | -10.73 % | -15.63 % | +9.51 % | +7.96 % |

| Reference Indicator | +11.38 % | -5.23 % | +14.51 % | +20.59 % | -10.27 % | +20.61 % | +8.54 % | +4.86 % | -14.85 % | +6.11 % | +15.67 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Emergents A EUR Acc | -2.44 % | +7.17 % | +4.95 % |

| Reference Indicator | +1.67 % | +5.25 % | +5.32 % |

Scroll right to see full table

Source: Carmignac at 30/09/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,88% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Carmignac Emergents A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Source : Carmignac, 30/06/2021.

1 Source: Bloomberg, CLSA, Bernstein, company data, 30/6/2021.

2 Source: Bloomberg, CLSA, Gartner, WSTS, Bernstein, company data, 30/6/2021.

3 Source: Carmignac, 30/6/2021.

4 The EU Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 “lays down harmonised rules on the provision of sustainability-related information with respect to financial products”. For further information, see https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

5 Carmignac Emergents has been awarded the French and Belgian SRI labels. See https://www.lelabelisr.fr/en/ ; https://www.towardssustainability.be/ ; https://www.febelfin.be/fr.

Socially responsible investment at the heart of our approach

Since its inception in 1997, Carmignac Emergents has combined what we consider our emerging-market DNA since 1989 with our commitment to strengthening our status as a key name in socially responsible investment. In welding together those two areas of expertise, we aim to add value for our investors while leaving a positive imprint on society and the environment.